As Salamu Alaikum,

What Halal options are there for Childrens Savings accounts / University funds.

Are the options to invest in general Shariah Mutual Funds or robo advisors such as Wahed Invest?

Or are there any specifics for childrens savings?

As Salamu Alaikum,

What Halal options are there for Childrens Savings accounts / University funds.

Are the options to invest in general Shariah Mutual Funds or robo advisors such as Wahed Invest?

Or are there any specifics for childrens savings?

Walikum as salam Richard,

Can I ask your investment horizon? assuming you will need the funds for kids in 10+ years?

Regards

Zeeshan

The aim here would be investing in regular format (monthly) x amount for around 18 years for example when they go to University etc

In order to avoid having to pay debt in tuition.

Salams Both,

I hope its ok if i can reply, I am looking for a Children saving(investment or trust) as well.

I have googled around and found Child Trust Fund - Shariah by foresters - see below.

Has anyone use them? or know anything about it?

also there are Junior ISA accounts ( see two below.

From my understanding (Correct me please) the problem is after the child reach 18 the money is legally their and parents have no control?

https://www.redroseassurance.co.uk/red-rose-assurance/our-products/junior-shariah-isa.aspx

https://thechildrensisa.com/shariah/\

What other options are there?

Good find on Foresters. Will have to take a look.

Yes normally the money becomes theres upon turning 18.

I am open to this model or just a normal model in which the money & tax remains in my name.

There are under 16 savings accounts:

https://www.alrayanbank.co.uk/savings/young-persons-savings/

Child trust funds are stopped now though:

Excellent!! regular investment over a long investment horizon is the way to go ![]()

![]()

Point to note:

Summary:

A simple DIY solution could be as follows (This is not a recommendation and you should do your due diligence)

Know when you need your savings and want to see how much you need to save regularly?. In the gross annual interest rate field, you can assume a 5-6% growth for equity. You can come to this link say annually to see if you have to adjust monthly payments to reach to your goal.

Open a junior ISA @ AJ Bell (They offer the most shariah-compliant funds that I am aware)

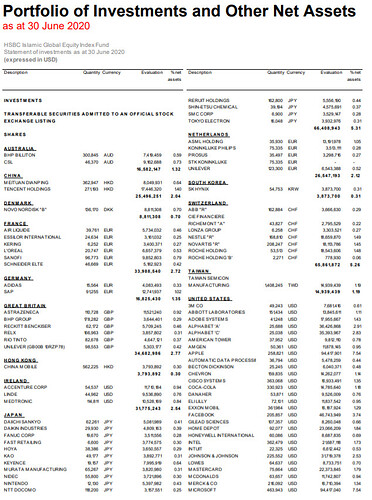

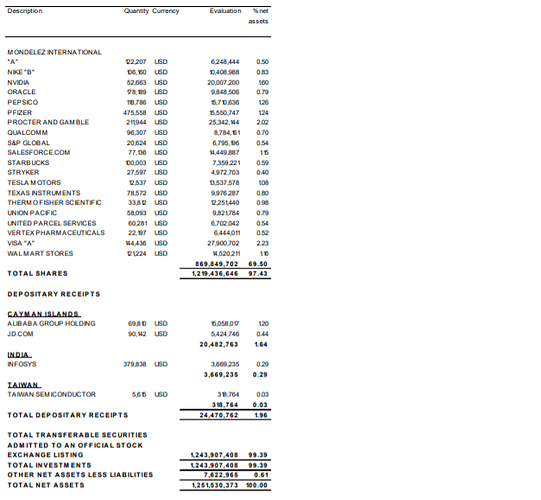

Select a fund of your choice. you may find this thread useful. Personally, I would keep it very simple and similar to what redroseassurance are doing as shared by @Investor i.e. investing in the popular HSBC Islamic Global Equity Index “BD” fund. Considering a long term horizon, maybe allocating 10% to iShares MSCI EM Islamic UCITS ETF.

Setup regular investing as a direct debit with the platform.

Sit back and have loads of fun with the little one ![]()

One last point…remember “It’s not about timing the market but its time in the market”: Stay calm and don’t do anything with the volatility in the market (even if it crashes in near future, it will more than likely be a winner in the end). Equity is volatile in nature but outperforms all the other asset classes in long run. Loving your long horizon ![]()

Don’t hesitate to ask if you have any questions.

Good luck!

Jazakallah

Zeeshan

Assalamikum Zeeshan,

Thank you for your feedback and reply!.

Whats the difference between ‘IC’ and ‘BD’ in the HSBC fund?

HSBC Islamic Global Equity Index “BD”

HSBC Islamic Global Equity Index “IC”

As Wahed and Simply Ethical invest into the ‘IC’ not ‘BD’

JazakaAllah Khiran

Thankyou Zeeshan - great help.

Walikum as salam Investor,

IC = Accumulating share class denominated in USD

BD = Dividend paying/distribution shares class denominated in GBP.

You may find this thread useful around this fund Selecting an ETF

Assalaamu alaykum Zeeshan,

JazakaAllah Khiran for that.

Is the ‘IC’ and ‘BD’ the same fund in a different class.

Sorry, silly question, what does it mean by class in funds? ( I understand ones is USD and other GBP)

Does the ‘IC’ and 'BD" have the same portfolio companies?

Does that mean ‘IC’ does not pay dividend?

For me as UK person, its just worth buy into ‘BD’ rather than ‘IC’ and not paying the 1% FX charge, if its the same fund itself?

Thank you

also, in the other post link you gave, you listed all companies in HSBC fund.

where did you get that from?

Yes

The funds can have different classes in different currencies and charges to cater to different audiences such as retail or institutional customers

Yes

It is an accumulating fund - the dividend is reinvested automatically.

Agreed - but you will have to reinvest the dividend manually or check with AJ bell if they can do it automatically on your behalf.

All the best

Please note that is just for indicative purpose and a snapshot in time- The holdings keep changing in line with any changes to the Dow Jones Index it follows.

JazakAllah Khiran

Thanks for sharing this Zeeshan. Atm i am just putting funds into Wahed. Is what you suggested a better yield?

Salam,

What i said that there are two approaches to investing - one is ready made portfolios and other is “do it your self”. the former will have additional fees and DIY approach will save a lot of money in long run.

Please go through my post again along with the educational link in it and decide for yourself as to which route you want to go ahead.

May Allah help you.

Regards

Zeeshan

There is now a “BC” equivalent to the HSBC Islamic Global Equity Index “BD” fund. This automatically reinvests dividend but there is a charge I believe but cheaper than manually investing from what I recall