walikum as salam

1. FUND COMPARISON:

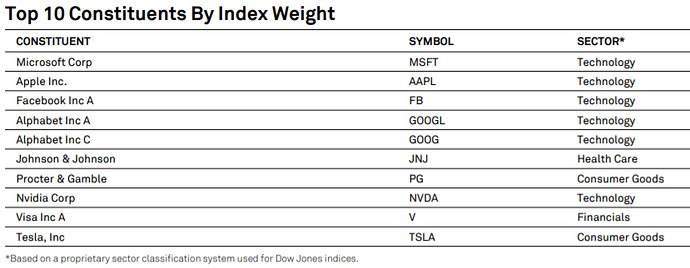

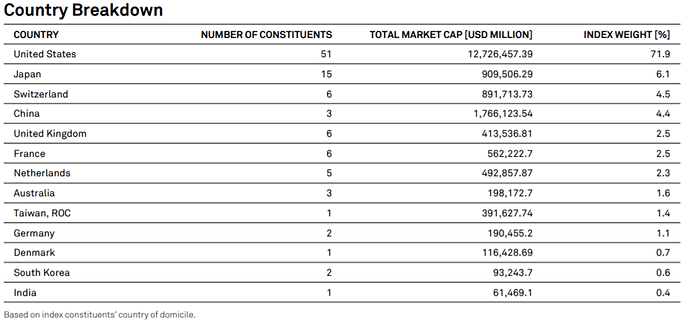

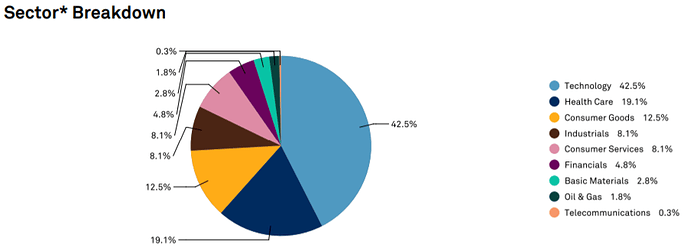

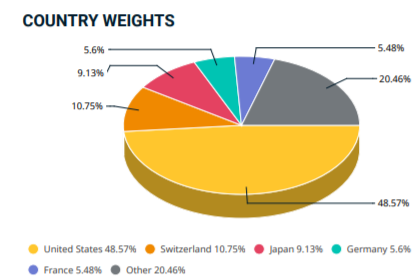

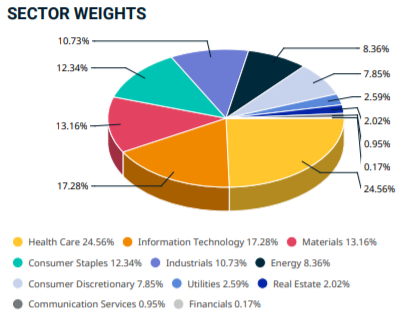

Overall i like HSBF fund over the Ishares MSCI. Dow Jones Titan 100 Index (HSBC fund) is biased towards US and Tech & Healthcare stocks which have been performing well and I believe both would probably continue to do so for a while in the long run. Though I would expect a short term correction coming to this fund as a result of likely rotation out of tech stocks to the heavily COVID battered stocks as we are seeing the progress on vaccines but I am still positive on its long term outlook - You may consider dollar-cost averaging if you do decide to go for this fund. I am a long term investor in this fund and don’t plan to do any funky stuff - probably will buy more if the market crashes  .

.

Some details around both the funds for your reference if you are keen to understand this more:

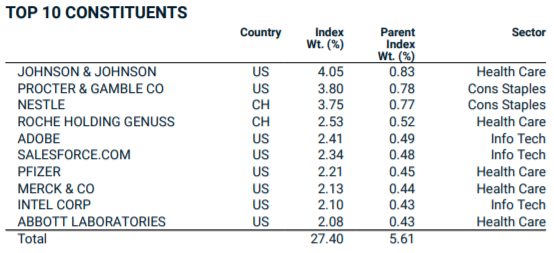

- MSCI World Islamic Index (USD): The MSCI World Islamic Index reflects Sharia investment principles and is designed to measure the performance of the large and mid cap segments of the 23 Developed Markets (DM) countries* that are relevant for Islamic investors. The index, with 366 constituents applies stringent screens to exclude securities based on two types of criteria: business activities and financial ratios derived from total assets.

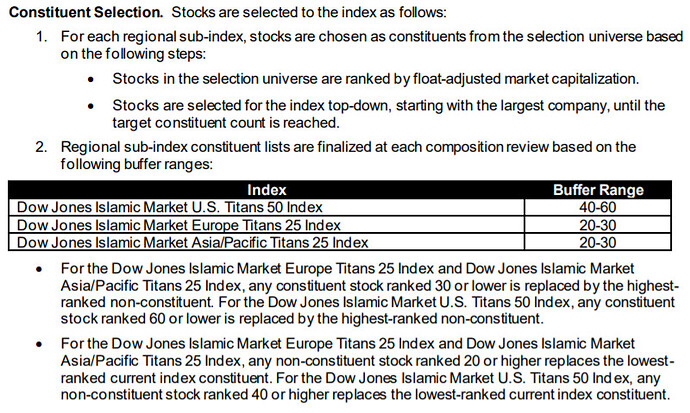

- Dow Jones Islamic Market Titans 100 TR USD (i.e. HSBC Fund): The Dow Jones Islamic Market Titans 100 Index is designed to measure the performance of the largest 100 stocks traded globally that pass rules-based screens for adherence to Shariah investment guidelines.

2. CURRENCY DENOMINATION:

The way it works is that as both the fund are global, underlying stocks are converted to either USD or GBP share class at “Spot rate”. As none of them is sterling hedged, you will have the currency risk regardless of which version you buy. However, it’s better to go for the GBP denominated fund as buying a USD denominated fund usually incur an FX charge of ~1% from the platform provider.

Hope this helps!

Regards

Zeeshan