walikum assalam Imran,

Glad to hear that you are finding this community helpful.

I am not aware of any other platform offering this fund at a lower platform charge then 0.25%. This is not to be confused with the fund charge which is generally around 0.5% that i have seen at most place. Let me know if you do come across with a lower fee anywhere. (T212 does not offer funds so this is not available on it)

You can invest in how many funds and stocks in an ISA account. What you may be confusing is that you cannot open more than 2 Stock and shares ISA in one tax year but there is no limitation of a number of holdings in the ISA account.

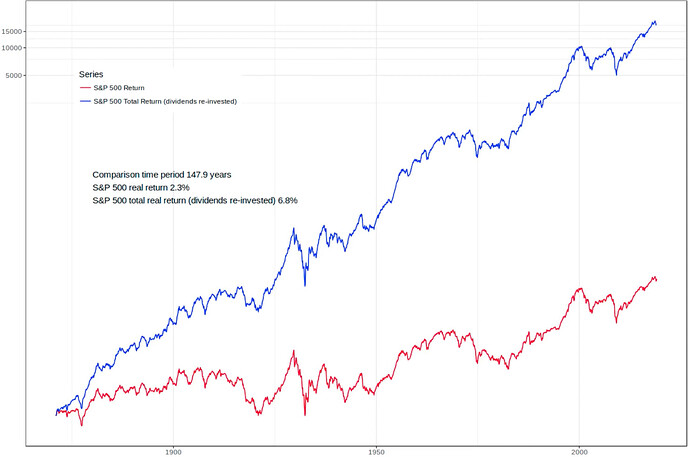

Dividend reinvestment simply means that whatever dividend you receive, you would reinvest them rather than using it. compounding effect of dividend reinvestment is unbelievably powerful. See below screenshot showing a 147 years history for gains with (blue line) and without (red) dividend re investment.

Now to your question, there can be two versions of the same fund one which is paying a dividend and other which automatically reinvesting dividend also known as accumulation funds. AJ bells offer HSBC fund in both classes but accumulating fund is being offered in USD currency which will incur a 1% fx charge from AJ belle when you invest and divest in it. The dividend-paying fund is in GBP and pays dividend half-yearly I think (pls check). Personally, i would invest in the GBP fund to save the 1%+1% FX charge and would just manually reinvest in the same fund whenever dividend is recevied.

Difficult to comment - maybe yes considering the fund itself has approx a holding of 100 shares VS MSCI Ishares but the shares within it are all growth stocks which have been performing brilliantly for past few years and my personal view is that they would probably continue to grow for some time. (Just my view). you may find this thread useful : Selecting an ETF

PS: for your pension, you should also check that the fee you are paying with standard life is lower than what you could pay to AJ Bell within SIPP i.e. 0.79% total (HSBC fund fee 0.49% + AJ bell platform fee 0.25%). If you are paying more then this then worth considering opening a SIPP with AJ bell and transfer your pension with them.

Hope above is helpful - feel free to ask any further questions.

Jazakallah.

Zeeshan