Still not convinced unfortunately my brother. The rules they mention are not new, they were always there and have always been explained very nicely if you read through various literature. The ‘crux’ of the matter is how you decide if a particular company/investment is meeting all the shariah principles and the info that you rely on to reach the conclusion. You must be aware of what kind of ‘behind the doors’ practices that goes on simply to ‘show’ a company to be ‘worth investing in’ and many times the right info is simply not possible to get to. Plus, lets assume you got all details for a particular stock and the info is also genuine so you go and invest. And next year, the board of directors decide to ‘take more debts’ and their ‘debts to asset ratio’ increases and goes beyond the ‘shariah threshold’. What do you do ? This is just one example. There could be so many such things that can disqualify the stock and push it outside the bounds of shariah. Hence I say it is ‘risky’ and to avoid is better in my opinion and in the opinion of the contemporary scholars which I support. End of the day, it is personal choice. I personally believe, if it is destined for me, it will come. Why should I un-necessarily take risk ? Now you will say the usual argument that then don’t even go and work  but this world is ‘darul-asbab’, we have to adopt ‘asbab (means)’ but that does’nt justify doing anything and everything. After all, this boils down to ones faith and takwa I suppose.

but this world is ‘darul-asbab’, we have to adopt ‘asbab (means)’ but that does’nt justify doing anything and everything. After all, this boils down to ones faith and takwa I suppose.

@Jamal_Yasin allright bro… im just saying it´s approved by shariah and they are clear about the rulings… and shariah reviews everything very strictly. i don´t think allah would let shariah make a bad decision in these things. at the end they are the islamic law… in my opinion what i trade before that i have to give up (which was hard) gues this opend a new door for me for the sake of allah. but yeah everyone has their views and cannot tell who is wrong…

@Jamal_Yasin when the debt increaes there is an explaination on this forum what you are suppose to do

walaikum assalam rahmatullahi barakatuh. I yes, I understand you my brother.

Salam Mufti Faraz ,

Trading 212 offers fractional shares in their Invest & ISA accounts , is it permissible to buy a small portion of the share for example buying 0.3 of TESLA at $300 ?

Wa alaykum salaam,

Yes, fractional shares are permissible to buy as long as everything else is Shariah compliant.

Allah knows best

As salamu alikum @Mufti_Faraz_Adam

I’ve come across a platform by Trading212 called ProQuant.

This platform allows you to build or follow automated strategies stocks, forex and cryptos through a mobile app.

It uses something called a “Strategy Generator”, which

“using complex algorithms, it composes strategies automatically, evaluates each strategy by backtesting it against historical data, presents the results in stats and charts and shows the most profitable strategies found. Thus, instead of manually testing the performance of each combination of various rules, traders can set their own basic criteria and ProQuant generates and backtests thousands of possible strategies to present a list of the top performers. The whole process takes mere seconds, then the trader can immediately save the strategies, run or modify them. The PQ strategies run in the cloud utilizing vast computing power so that traders won’t have to deal with any technical issues.”

There are some terminologies that I am not familiar with on the link below:

https://www.proquant.com/user-guide#:~:text=ProQuant%20lets%20anyone%20build%20and,players.

But I would be interested to know your view on this and if it is halal.

Kind Regards

MS

Wa alaykum salaam,

As long as you are using the algorithms to trade in Shariah compliant financial instruments, Shariah compliant processes and facilities, it is permissible to use such algorithms.

Allah knows best

Are u sure there is no short option??

@Abba yes there is no short option on the invested account… only on the cfd account…

Wrong. Trading 212 is NOT HALAL. The invest account is not swap free, they do charge interest. This is something that even the app itself says. So brothers, Trading 212 IS HARAM.

@Abd_Ever

Ik think you confuse yourself with cfd account brother… in real stocks there no such thing as swap… only applied for cfd

I am not confusing with cfd. Are you sure that the invest account does charge anything at all for overnight positions?

@Abd_Ever

selam,

when i was with trading 212 i didn’t have swap on invested account. you can always ask them.

greetings

@ARIFUL_HAQUE

selam,

there is no such thing as islamic account… a cfd account has swap. when you have swap account means that u use leverage which is haram. and therefore you pay overnight interest.

on invested account or ISA account you don’t pay swap because you cant use leverage. because u pay real stocks.

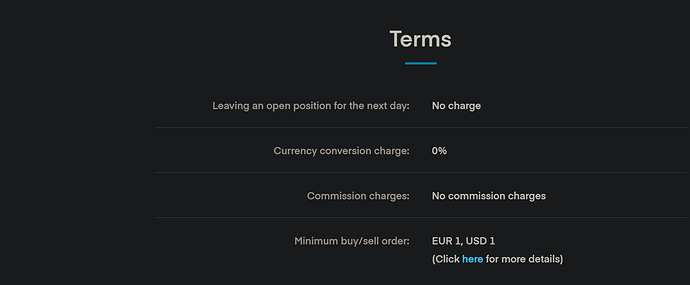

These are the terms on invested account :

from two separate account type what could be considered as halal ? can i work with them ?

Selam, @ARIFUL_HAQUE

Only ISA account because invested has share lending program which is prohibited

Salam

I just wanted to know I have opened a trading 212 account but I wanted to which one is permissible for me to use

Trading 212 invest, trading 212 cfd or trading 212 ISA

Also I will personally look to be a swing trader as I look to wait a minimum of 5 days before I sell my shares and I just wanted to know if this is permissible so long as the shares that I sell are sharia compliant

Wa alaykum salaam,

The ISA account is the most preferred in terms of Shariah compliance.