1.Salam bro, I hope you we’ll In Sha Allah.

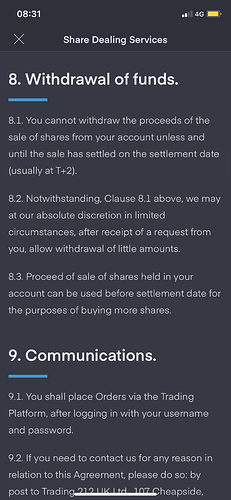

I have a few very important questions, the first being, I know when it comes to buying stocks, islamically the safest opinion is that a stock needs to settle or realise full ownership before it can be sold (and this occurs after the settlement period of T+2/3 days depending on your broker). This concept I understand, and don’t have any problems with, my first question is however, when a particular stock is sold, the cash gained/lost from that sale also has a settlement period, for example, trading212 has a cash settlement period of t+2 days (in this period the cash gained/lost from the first sale is still accessible to you and can use it freely to purchase another stock, it’s just technically not yours at that moment, essentially, the cash is yours to do as you will freely, the only restriction in this settlement period is that you cannot withdraw any cash until it has settled, however you can purchase and sell stocks with it, I will attach a screen shot of trading212 terms and conditions to make this clear), therefore, according to the AAOIFI standards, can you use the money from the original/first sale to purchase another stock before the cash actually settles/settlement period or do you have to wait until your cash has settled islamically before you can reinvest

2.My second question is that, when screening balance sheets, sometimes the interest expense outweighs or is higher than a companies interest income, and the balance sheet will only specify the net value of the expense minus the income, for example, company X has an interest expense of 10000 and its interest income is 5000, the balance sheet would specify overall interest expense/income is -5000, however a lot of the times it doesn’t specifically state the interest income, it just gives an overall value of interest income minus interest expense,and upon reading the notes associated with the balance sheets (I.e. 10-Ks) a lot of the times the breakdown of the interest income is not given, so in situations like this as the net interest income is negative due to having a higher interest expense, is the actual interest income nullified? Meaning we don’t actually need to know or include as part of our financial screening?

Essentially, when looking at Interest income of a company, if the interest expense is larger than interest income does it automatically pass that screening for interest? Or do you have to look at the interest income by itself? If you have to look at the interest income by itself what would you do in situations where it’s not explicitly stated within a companies financial balance sheets or the notes for the balance sheets? Again this question relates specifically to the AAOIFI way of thinking/standards.

3.Does the majjallah course which you’re offering go through the aaoifi way of screening and investing in stocks in detail or does it go through another method/criteria, I ask this because you’re on the aaoifi board and I’m interested to learn the way aaoifi way of halal stock investing so I would pay for the course if this is available within it in detail?

-

On your Twitter page, you posted something a few months ago in October stating that you’d be giving a 3 webinars on 3 different aaoifi standards. The third of these webinars was on aaoifi standard 21 for shares and bonds which you were scheduled to give 15th dec 2020, I could not attend as I wasn’t aware that you were giving this webinar at the time, is there any way to access it to rewatch as I found that on YouTube the first of those webinars you have on standard 35 for zakah is available to watch but the other two are not available anywhere on the internet, specifically I would find it very useful to have access to the third webinar specifically to gain a better understanding of the AAOIFI standard 21 in practical terms and I know several brothers feel the same as information is very scarce, so would it be possible to have it uploaded or something along those lines on YouTube?

-

According to the AAOIFI standards 21 that I read on their website, according zoya, and according to numerous articles I’ve read, the way to screen stocks financially is to use the current market cap of a company when applying it to the different formulas I.e. total debt/current market cap, this is how I have been investing and profiting, but I read somewhere that the market cap should be a value which is averaged over 12 months and not the actual current value for the aaoifi way of screening to determine compliance, I found this confusing and worrying as 99% of research indicated and even the standard itself indicated that the current market cap should be used, so could you please clarify what the correct manner is and if I’ve been wrong or if what I’ve been doing is ok, it’s pretty difficult and tedious for an average investor to calculate the 12 month average market cap and like I said most of my research did not indicate this neither did the standard specify this on the actual website of AAOIFI. Maybe @saadm could help clarify this also.

These questions have been bothering me for some time now would love some clarity, jzk in advance I apologise as I know I’m asking a lot.