Is it permissable to invest in a company that owns preference shares of another company in an amount exceeding 30% of the market capitalization?

Wa alaykum salaam

There can be a difference in treatment between the way accounting standards classify preference shares and how the Shariah treatment will be.

According to IAS 32, preference shares can be classified as equity, liability, or a combination of the two. For example, a preference share that is redeemable only at the holder’s request may be accounted for as debt even though legally it is a share of the issuer. This could be because the substance of the terms and conditions requires the issuer to deliver cash or another financial asset to settle a contractual obligation.

However, in some cases, the instrument’s legal form can supersede the substance over form principle. For example if a local law, regulation, or the entity’s governing charter gives the issuer of the instrument an unconditional right to avoid redemption—in such cases, the instrument could be classified as equity.

From a Shariah perspective, in many instances, preference shares will be classified as financial liabilities, as the entity has a contractual obligation to make

a stream of fixed dividend payments in the future. This means that the ‘dividends’ will be treated as interest payments and included as an expense in the Statement of Comprehensive Income. Thus, this would then be tested against the 30% interest bearing debt ratio.

The above are just my thoughts on the matter. However, each listed company will be reviewed by Shariah stock screeners and the Shariah board to ensure the correct treatment.

Allah knows best

Thank you, but you don’t understand me

Its quarter report of bio rad:“As of September 30, 2020, we own 12,987,900 ordinary voting shares and 9,588,908 preference shares of Sartorius AG (Sartorius), of Goettingen, Germany, a process technology supplier to the biotechnology, pharmaceutical, chemical and food and beverage industries. We own approximately 37% of the ordinary outstanding voting shares (excluding treasury shares) and 28% of the preference shares of Sartorius as of September 30, 2020. The Sartorius family trust and Sartorius family members hold a controlling interest of the outstanding voting shares. We do not have any representative or designee on Sartorius’ board of directors, nor do we have the ability to exercise significant influence over the operating and financial policies of Sartorius.”

My question: is it 9,588,908 preference shares, deposit or cash and cash equivalents?

great explanation of preference share @Mufti_Faraz_Adam

@Zimagur19071990 as mufti Faraz explained that preference share can be classified either as an equity or a liability from an issuer’s perspective. On the other side, whoever has purchased the preference shares will classify it as an investment. If the instrument is assessed to be equity from the shariah perspective, then the investor (Rad laboratories) is getting a dividend and similarly, if the preference shares are assessed to be a liability then the investor is earning an interest income.

“deposit or cash and cash equivalents” do not come into these scenarios. Cash equivalents include bank accounts and marketable securities, which are debt securities with maturities of less than 90 days. Looking at Rad’s financial statements, it does not appear to be falling in the category of cash and cash equivalent. So this is very clear.

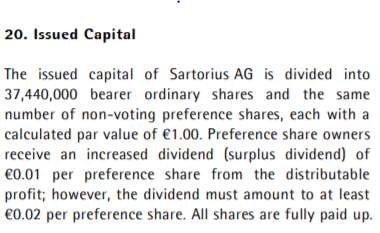

I have tried to hunt for information the published financial statements but its not clear. I guess you need to check what are the terms of the preference shares issued by Sartorius to assess it to be equity or liability - now the tricky bit is that accounting standard may classify it as issued equity but from a shariah perspective, the substance may suggest it to be a liability. Any way you can find out the terms of preference shares issuance? below is the extract from their financial statements the last sentence appears to suggest that the holders of the preference shares will get a guaranteed EUR0.02 per share which does not smell good to me from a shariah perspective.

Without complete information, it may be difficult to conclude in this.

And Allah knows best.

I concur with @Zeeshan and what he said is very reasonable.

Jazakallah khayran.