As salam aleykoum

I wish to present a protocol with a decentralized stablecoin and explore whether there might be a form of riba associated with its operation.

Liquity is a decentralized, non-custodial, immutable, and governance-free protocol that allows borrowing the stablecoin LUSD against a deposit in Ether (ETH) without a centralized intermediary. The system operates without interest, but with dynamic borrowing fees ranging from 0.5% to 5%.

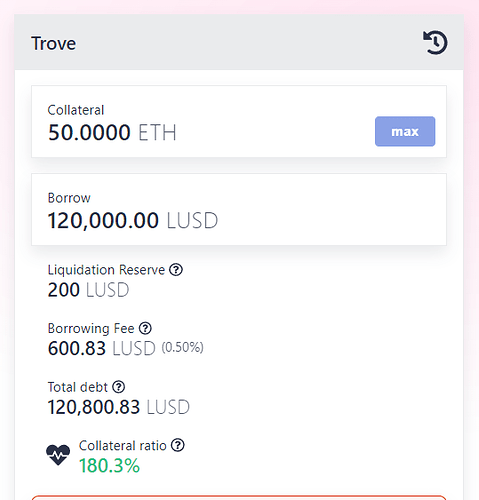

To use the protocol, users must open a Trove, a smart contract where they deposit ETH as collateral and can then mint LUSD. The minimum collateralization ratio required is 110%, including borrowing fees. This ratio protects the system from massive liquidations and maintains the stability of the LUSD value. For example, if the fee is 0.5%, the required collateral will be based on 100.5 LUSD, so 110.55 USD in ETH.

Borrowing fees on Liquity can vary depending on network demand and can reach up to 5% in some cases. This occurs when borrowing demand is particularly high, increasing the fees. However, these fees are applied only once at the time of opening the loan. The protocol dynamically adjusts fees to balance supply and demand, ensuring ecosystem stability.

Where do these borrowing fees go?

In the Liquity protocol, there are two essential components: the LQTY token and the Stability Pool. The borrowing fees, which are applied when users open a Trove, are shared between these two entities. A portion of the fees is redistributed to LQTY stakers as rewards to encourage staking, and the other portion is allocated to the Stability Pool. This pool is used to absorb liquidations of under-collateralized Troves, ensuring system stability by exchanging deposited LUSD for ETH during liquidations.

If the protocol can be so permissive, it is not because it takes more risks, but rather because several solutions are implemented to encourage users to re-collateralize when necessary: the recovery mode and redemptions.

Recovery mode is activated when the global collateralization ratio of the system falls below 150%. I mentioned earlier that the minimum collateralization ratio is 110%, which is the normal basis of the system. However, in Recovery Mode (when the global ratio of all the Troves in the system falls below 150%), additional restrictions apply. This results in stricter liquidations, where only Troves with a ratio below 150% are liquidated to protect the protocol’s stability.

Redemptions allow LUSD holders to exchange them for ETH by buying back the debt of Troves. This is prioritized by Troves with the lowest collateralization ratio. Redemptions can affect even Troves with a ratio above 110%, and even 150%, and do not require the system to be in Recovery Mode. Trove owners can lose some of their collateral if targeted by a redemption, even if their ratio is technically above the liquidation threshold. Therefore, being the least collateralized Trove in Liquity is not a very enviable position, as the collateral is at risk of being used for redemptions. If that is the case, the user will lose ETH but will also see their debt decrease (proportionally to the LUSD exchanged).

I believe I have provided all the necessary information about the protocol and its decentralized stablecoin. If you have any additional questions or points to clarify, please feel free to ask. I would also like your opinion on the initial question: do you think there could be a form of riba associated with using this protocol?

Thank you.

P.S. I forgot to mention the ‘liquidation reserve’ (shown on the screen). This is an amount set aside to cover the gas fees of the liquidator if your Trove needs to be liquidated. This amount increases your debt and is refunded if you close your Trove by fully repaying its net debt.