Assalaamu’alaikum wa rahmatullah wa barakatuhu

Dear @Mufti_Faraz_Adam, @Mufti_Billal, and all of my brothers and sisters in faith.

I would like to have your opinion and point of view of this.

I’m highly interested in trading forex (not yet started) and being aware of all its concern regarding shariah compliance. I’ve known so far that forex needs to be spot and CFD/derivative is seemingly non-shariah-compliant because of its nature and mechanism.

Sadly, it’s very very hard to get a broker that certainly doesn’t deal in CFD/derivative. Even if they stated “Spot Forex” and doesn’t mention any “CFD/derivative”, still, the trading platform (usually MetaTrader) looks like a CFD/derivate because of how trade is shown to user in the form of open/close position, thus whether or not we truly buy the underlying asset is obscure.

However, I came across this broker called Interactive Brokers (IBKR, for short) that looks promising.

-

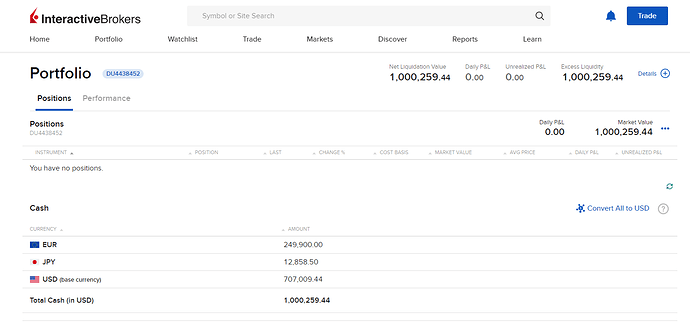

For forex, our account is denominated in multiple currencies. For example, if we started with GBP 1000 account, and we buy USDGBP pair for 100 units, our account clearly reflects the balance of USD 100 and GBP 925 (assuming 0.75 rate). This buy position doesn’t need to be closed like in other platform/broker: we can stay with this multi currency balance as long as we like. We can even buy other currency or product using that USD balance that we have. Moreover, all these currencies can be withdrawn or spend using their own debit card (of course it will be exchanged with the rate upon withdrawal). This confirms the buying of the underlying asset and ownership, doesn’t it? This is the screenshot of my demo account:

-

For commodities, especially gold, you may check their website page (US Spot Gold | Interactive Brokers LLC) where they state that we can request for physical delivery of gold (additional fee applies), although for US residents only. Even so, here on the details of fees (I can’t put more than 2 links) they state that there is a storage fee/cost, which means the gold is really there and we buy the underlying asset, doesn’t it? I don’t know with other commodities.

-

Regarding margin/leverage, they have two types of account: Cash Account and Margin Account.

-

In Cash Account, you can only spend what you have. The account balance is never negative in any currency. So, if you have GBP but wants to buy US stock, you have to convert it first to USD before you can buy the stock. Additionally, you can’t trade USDJPY or buy GBPUSD as it requires you to have USD in the first place to execute the order, unless you convert your money first to USD. I think this works like a normal bank account, just that it’s integrated with brokerage.

-

In Margin Account, you are allowed to borrow money, either leveraged or not. In IBKR, I think the concept of leverage on its own doesn’t mean a thing for our concern. For example, if your account only holds GBP but you want to buy US stock in USD right away, or trade USDJPY, or buy GBPUSD, you need to borrow money for the order to be able to be executed (in this case USD), either leveraged or not, because your GBP can’t be used. Even if you have GBP 1 million and want to buy US stock worth only USD 1, it’s still a loan. And in case of leveraged loan, you can borrow USD with the amount more than what you have in GBP (e.g., have GBP 1000 but buys US stock worth USD 2000). So, in my opinion, the leverage doesn’t matter here, it’s still borrowed money, no matter the amount, no matter if leveraged or not.

Unfortunately, IBKR doesn’t provide a swap-free account (as it’s not a swap!), and interest will always apply daily. However, since I want to day trade and this style of trading ensured itself that there is no overnight positions, and since IBKR explicitly says that as long as negative balance is closed within the same day it bears no interest (Frequently Asked Questions - IBKR), can I utilize the borrowed funds to trade?

I personally always thought of this kind of loan (no interest within some period, like this and credit card) as a no-interest loan because I commit to myself to pay it back in time and I ensure myself to have the capability to pay within the stipulated time. If I cannot commit or I can’t ensure my capability, I will never take this kind of loan.

And Allah knows best.

Wa’alaikumussalam wa rahmatullah wa barakatuhu

Jazakallahu khair.