Salam my brothers and sisters,

My name is Ishaq out of NJ, USA and I’ve been involved in the investment/distressed real estate space for quite some years now. Through my journey in this industry, I’ve remained true to faith Alhumdullilah and avoided the use of interest/riba based loans and referring others to same. Up until recently, there hasn’t existed any real sharia compliant product in the investment space here in the US that would finance distressed properties. We have Guidance Residential and UIF but they’re both conventional financing companies and will not finance properties in need of rehab/repairs.

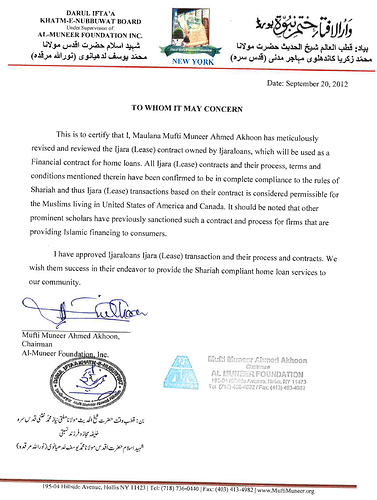

However, recently, someone brought to my attention that a company known as IJARA CDC, which apparently is run by a group of individuals who originally geared into place Islamic finance in the US, have released a “Conversion Product” in which they basically convert an interest bearing loan into that of an Islamic compliant one, but only post closing.

The idea is that you’d sign into an interest bearing loan and close on your property with that loan but have the niyah/intention of the Islamic loan and quickly post closing, back to back, implement their Ijara structure and convert the loan into a halal one,

Their websites are:

https://halalfixandflip.com/

From my understanding, the parent lender where the funds come from is Voro Capital

https://voropro.com/programs/capital/

After you sign and close with Voro and their interest rate it, Ijara CDC converts it and you pay a profit rate.

Im not sure of the permissibility of this hence why I’m here on these forums.

If this is indeed permissible, it would be huge in catapulting my investment business to new heights by helping me leverage my capital and take on more distressed projects and bring them up to par and ultimately improve housing in more neighborhoods,

Would love to hear the thoughts of the knowledgable.

@Mufti_Faraz_Adam @Mufti_Billal

Barakallahu Feekum,