Hello,

I am genuinely interested to get a detailed answer to this, crypto assets trading is relatively new and some of the traditional financial concepts possibly do not apply i.e Forex and conventional futures.

I have been searching and also reading some of the posts on this forum and other Islamic website on the subject, but most of these generally to traditional finance.

Here is my understanding and some questions for discussion:

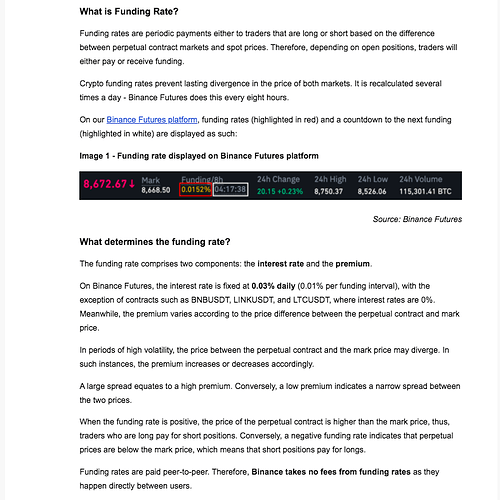

Marging / Leverage Trading (Interest) - there is no interest on the margin, but there is a funding fee directly between buyer/sellers to incentivize liquidity. There are other post on the forum regarding this but there is no response, just many many questions. The funding rate is applicable whether you are using leverage or not.

So, what exactly is the issue with the funding rate?

Gharar/Maysir - I suspect these would be present, but if there is due deligence in technical analysis and study of the markets, this is reduced to probabilities and you are exucuting the order with high probability. As mentioned, here Chart / Technical Analysis is not considered haram. Depending on the view taken, day trading / margin trading can be considered as a form of gambling.

I suspect this is a moral question, when is trading considered gambling?

Derivatives - With my limited knowledge, the main issue here is possession and/or delivery of assests. As these are digital assets the issue of delivery is probably not applicable (inverse contract); as for possession, I suppose there is the initial margin plus the leverage as mentioned above. I have not found anything to suggest that borrowing money to generate profit is haram. Again, this is just based current understanding of what I have read so far.

Derivatives is minefield and I do not pretend to understand it, the above statement is oversimplification of very complicated subject.

Zero Sum Game - I guess day trading is a zero sum game, I don’t really know where to stand on this one.

I am a creature of curiosity and pedantic with subjects of interest, I am looking to generate a discussion, potentially something that leads to further reading. Please respond with details. I appreciate your understanding and willingness to take the time to provide a detailed answer.

Thank you,

jazakallah khair