Assalmu Alaikum WRWB…

I am located in USA and my question is regarding my retirement plan (403b) which is offered from my employer. My employer contributes 3% annually to this plan, whether I contribute to it or not, however in order to encourage employees to save for retirement, my company has a policy that if an employee contributes a portion of their paycheck to the retirement plan, the employer will match their contributions by 1/3 of the amount that the employee contributes. (e.g if I contribute $1000, my employer from their end would contribute $330.).

Also When a person places money into the plan, it acts as a tax shelter (i.e. pre-tax income goes into the plan) and when a person (presumably when they’ve retired) takes money out of the plan they are taxed on it. The idea is that when a person takes money out of the plan they would be taxed less because they would most likely be earning less money in the later years of their life. Also, by investing in this plan, ones taxable income is decreased, hence it works as a tax shelter as well.

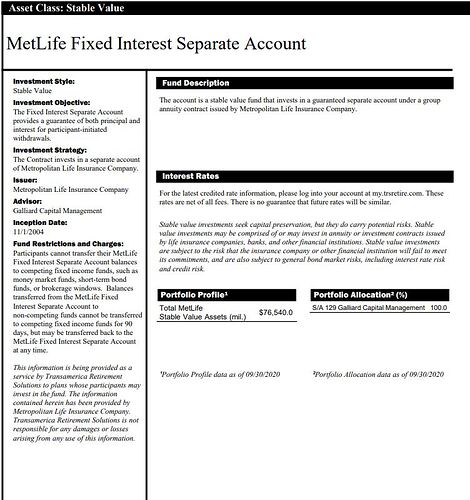

I have the option of either investing in a select line of bonds, stocks or mixed mutual funds. I reviewed all the options and found that all of the funds invest at least a portion of the money in the financial sector/banks etc. I called up the company who my employer has chosen for our retirement plan and inquired if I could self direct the money to funds or stocks of my choice or leave it at minimum in a checking account with no growth. The only other option I have is a Fixed Interest Separate Account (where each year I get a set percentage in interest). I can run a report and see how much I earned in interest for any given time period.

Can I contribute to this plan if I keep all my money in this fixed interest account and keep track of the interest rate for that year and give it in charity when I withdraw at retirement? The benefit to me is, I will get extra money from my employer (employer match 1/3 match) as well as receive a tax break from the government.

Below is a screenshot of the Fixed Interest Account. And the 1st reply has the Fund options. I was unable to add 2 screenshots to the initial post.

Please advise if you need further clarification on anything.