Asc

I have a question:

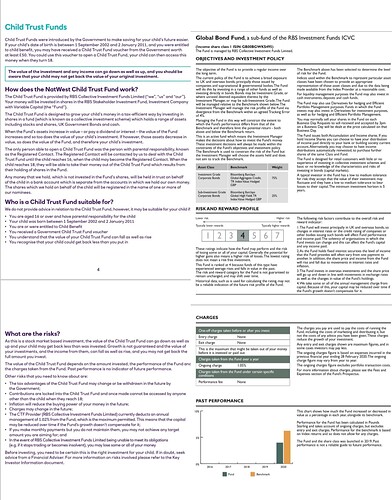

My parents opened for me a child trust fund. This is a long term investment in which money is put into an account from a young age so the child will have available to them a sum of money when they reach 18. Mine is a stakeholder child trust fund and it is an accumulation fund.

The government put in some money into my fund at the beginning and my parents would also add some money into it.

The money is invested in a fund and the share price of the fund can increase or decrease.

My main concern is that I don’t know which companies my money is invested in and when I was reading some of the documents about this, there was mention of interest even though it is to do with shares/funds.

My fund is the RBS collective stakeholder investment. 67% of the fund goes into companies, so is it reliable. I will send a screenshot of the assets below. So is it safe to keep 67% of the money gained from the fund. I read some of the other answers and they said to guess the amount of money that was clean. Is this a suitable method and can I keep this money? What I mean is, can I keep 67% of the money that came about from the investment. And if not, what amount of the money that increased from the investment can I keep? I know that I can keep the initial money that we put in.

Link: Equities, ETF and Funds prices, indices and stock quotes - FT.com

Screenshots of the documents that I am referencing earlier.