Salaam, appreciate the work you guys do here.

I have a query in regards to the article on PCP / HP car finance.

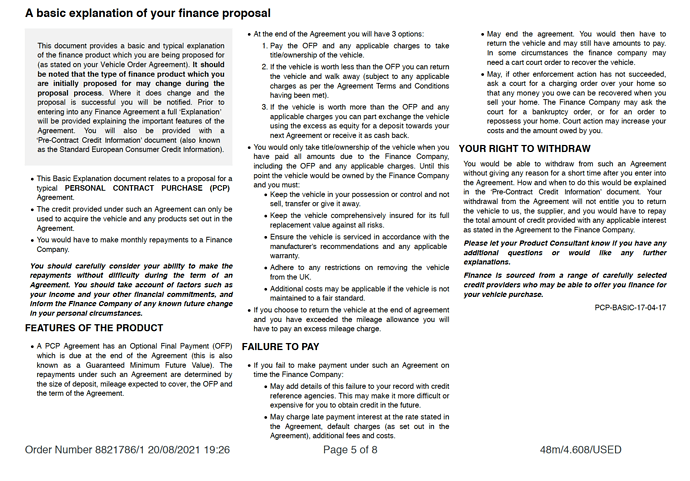

So i understand each individual contract for PCP would have to be reviewed to determine Shariah compliance, but i have some questions they are not specific agreement related but more principles:

- Would it affect permissibility if the financier was the manufacturer owned finance company, or instead a 3rd party?

- If i was to provide a PCP contract for review - how should i do so?

- If it was deemed the contract was halal what would that mean (from a permissibility perspective) if I was not to keep the car the full term of the PCP e.g. 4 year term, and i decided after 2 years i need to change so would have to sell the vehicle and clear the finance, would this make the PCP (from a principle perspective) impermissible?

- If it was deemed the contract was halal what would that mean (from a permissibility perspective) if I kept the vehicle for the term and then chose the option of purchasing the vehicle from the financer at the pre-determined price of X amount, would this be permissible?

I would like to say barakallahu feekum for your efforts, you have done a great job in providing islamic context for modern finance related topics. They have no doubt helped many a layman like myself.

Would really appreciate your thoughts on the above, so many thanks in advance.

Adil