Jazakallah khayr Mufti for the answer.

I have realised that I misunderstood how the Trust Fund worked, and I clarified with people familiar with UK finance.

There are different types of Child Trust Fund accounts, and my father decided to choose a stakeholder one (rather than a savings account where money is deposited and left to accrue interest while family and friends can add more money).

When the money from the government was given, this was used to buy shares. For example, in 2009, I had 1863 shares — the government had given £500 and this was used by my father to purchase these shares.

In 2010, the government had given £500 again, and this money was used by my father to purchase more shares — I had 3422 shares.

Because no more money has been deposited into my account either by the government or by my parents, I still have 3422 shares, but the price of those shares has increased. In 2010, I had £1200, and in 2020 I now have £1700, but the amount of money fluctuates a lot throughout the year; in April, it was £1400.

Please forgive me for accidentally misleading you by saying that the first £1000 in my account was from the government and the £700 was from the investments. In fact, all of the money - £1700 - is from the investments and the value of the shares.

Units 3,422.188 + Unit Price £0.502 = Fund Value 1,717.94

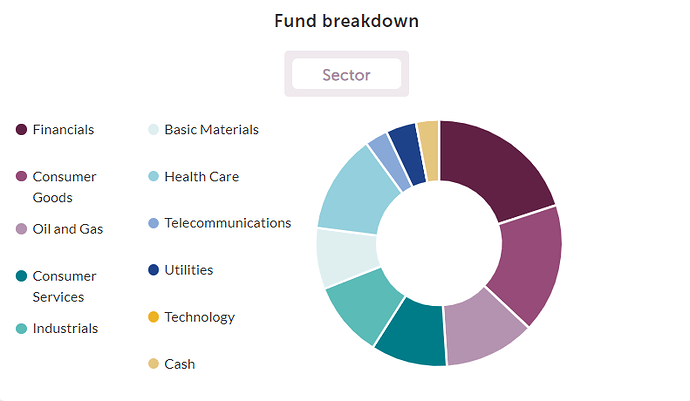

My account does show a graph breaking down the fund in terms of the different sectors.

I know that a percentage of the money will need to be donated because it may have been involved in haram business. What figure would you propose? Some of these sectors are more likely to be involved in haram, for example 20% is from financial sector, while telecommunications or healthcare do not seem problematic. I have been advised by one person to donate 25% as a precaution.

Jazakallah in advance!